Before summer arrives, many people are thinking of beach or tropical island getaways, with all the wonderful things that come with them. Cruises, deep-sea fishing, or just lazy days on the beach drinking fruity drinks and listening to the ocean waves, are all sought after for relaxation and enjoyment.

However, the beginning of summer is also the beginning of the Atlantic hurricane season. Is it safe traveling during hurricane season? Let's explore the facts.

When is Hurricane Season in the Gulf of Mexico?

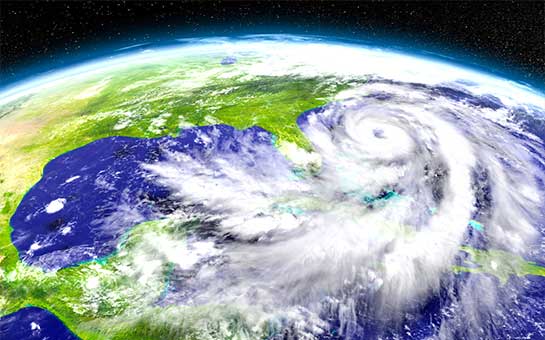

The Atlantic hurricane season runs from June 1st through November the 30th. While hurricanes can happen at any time, this is the time of year when the majority of them are expected. These storms usually affect the islands of the Atlantic region, coastal areas along the eastern seaboard of the U.S., as well as the Gulf of Mexico affecting the southern U.S. and Mexico. These storms can cause major devastation and destruction to whatever areas they impact. And all it takes is one look at a Caribbean hurricane belt map to see just how many locations Hurricanes can affect.

This kind of storm goes by different names in different regions of the world. The term “hurricane” is used in the North Atlantic and the central and eastern North Pacific. The term “typhoon” is used in the Northwest Pacific. The term “tropical cyclone” is used in the South Pacific and in the Indian Ocean. All three of these storms refer to the same natural phenomenon: a rotating system of clouds and thunderstorms that forms over tropical or subtropical waters; has closed, low-level circulation; and has sustained winds of at least 74 miles per hour (about 120 kilometers per hour).

Travel Insurance for Hurricanes

It's important to know, that there are two types of insurance available to you that can provide protection both medically and financially.

- Trip Insurance is insurance that provides financial protection from named losses that can cause a trip to be cancelled. These plans can reimburse for non-refundable trip costs, flight delays, missed connections and lost luggage. It's a good idea to purchase this type of insurance as soon as you make your initial trip deposit, to be eligible for the maximum amount of plan benefits. Plans can offer trip cancellation benefits if your destination is under a hurricane warning issued by NOAA, or the National Hurricane Center.

- Travel Medical Insurance, which is meant to cover all new illnesses and injuries that occur or manifest after the effective date of the policy. If someone were to become ill or receive an injury during travel, these plans will cover for medical expenses up to a chosen policy maximum, as well as provide medical evacuation benefits. These benefits could be extremely important if your destination were to be impacted by a storm and you are injured.

These types of insurance plans can be purchased easily, at reasonable prices, with no documentation required, and can start as early as the next day. There are different options for all budgets and the insurance can provide piece of mind incase something were to happen when traveling away from home, or before your travels even begin. Being prepared is a great way to start relaxing and enjoying your travels.

Can't find answers to your questions?

Ask our specialists - Licensed and experienced insurance professionals in the U.S.